Guide To Sleep Apnea Life Insurance

Wouldn’t it be nice to wake up like this every morning knowing that you found the perfect term insurance policy- even with sleep apnea?

If you are searching for sleep apnea life insurance, you’ll love this article…

There are a TON of other sites that merely “discuss” sleep apnea and a basic overview of the life insurance application process.

One of my main Competitors, Quotacy, has a popular blog post, but no others delve as deeply into the subject of sleep apnea life insurance as we do in this guide and on our entire site.

In fact, not even PolicyGenius or LifeInsuranceByJeff come close to going as deeply into the subject of sleep disorders and life insurance.

And why would they?

It takes a MASSIVE amount of time and research to come up with excellent resources on high risk life insurance.

So, if you want detailed information on your condition, and the best possible guidance during the sleep apnea life insurance process, then keep reading this guide.

You may want to bookmark this page and come back a few times. This article is THAT detailed.

Let’s face it, sleep apnea is a pain in the neck! So many more people have been diagnosed with it in the last 25 years that it’s now a huge industry.

That also means that if you’ve been diagnosed with sleep apnea and you need, or think you need life insurance, you’ll need someone to guide you through the life insurance process.

And that’s exactly what’ll I’ll do in this article. You see, you’re not alone in this. I have moderate OSA and I “get it”.

So, keep reading and you’ll get the most information on sleep apnea life insurance on the internet.

You’ll also get ACTIONABLE steps you can take to get the lowest price on your life insurance.

Simply keep reading feel free to chat with us in the chat box if you have any questions!

Take care,

Chris

My Name Is Chris Acker, CLU, ChFC. I’m a life insurance broker and I have sleep apnea… I Was Diagnosed With OSA In 2004.

My AHI Without Treatment Was 35. I Started Using CPAP In 2004 And My Life Changed! My New BIPAP Device Measures My AHI At About 2.5 Each Night. My life insurance company now loves me since i’m CPAP compliant!

I know that getting life insurance with sleep apnea is vital to your family. I also know that it’s difficult and confusing when you know your have sleep apnea and you want to get term insurance.

There are hundreds of online term insurance quote sites out there, but none that specialize in sleep apnea life insurance. I’ve put this resource together for YOU, the sleep apnea sufferer. Please CALL US to ask any questions at all!

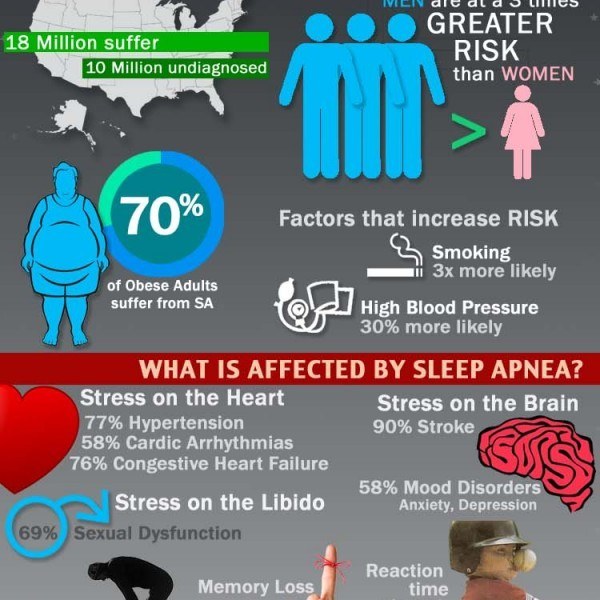

More Than 54 Million Americans Suffer From Obstructive Sleep Apnea

According to the National Sleep Foundation sleep apnea is very common, as common as type 2 diabetes. It affects more than 54 million Americans.

It’s a major contributor to many road and driving accidents across the country. Drowsy driving causes at least 100,000 wrecks, about 1,500 deaths and billions of dollars in property damage annually.

The problem is, many people don’t know they suffer from sleep apnea. Their condition goes either un-diagnosed or mis-diagnosed.

Those Who Suffer From Sleep Apnea Often Have A Difficult Time Getting Good, Quality Life Insurance That’s Affordable.

That’s why we’ve put this guide together for you and compiled a ton of information all in one place so we can help you get the information about your sleep apnea condition and how to navigate the life insurance with sleep apnea maze.

In This New Guide You’ll Learn:

- What Sleep Apnea Is And Why It’s Difficult, But Not Impossible, To Get Life Insurance

- What Sleep Apnea Does To The Body- Way More Than Just Snoring!

- How Sleep Apnea Is Treated And Why Life Insurance Companies Love To See Apnea Treatment Compliance- Especially CPAP Users

- Are There Any Permanent Cures For Sleep Apnea-What’s The Current “State-Of-The Art”

- What Are Some Home Treatments For Sleep Apnea?

- What Type Of Doctor Should I See For Sleep Apnea?

- What Totally Easy Things Can You Do To Help Yourself Get The Best Rates On Your Life Insurance Application

- What AHI And RDI Readings Do The Insurance Companies Want To See

- Do I Tell My Life Insurance Companies About My Sleep Apnea?

- Don’t Have Your Life Insurance Application Declined For Non-Disclosure…

- Who Has The Best, Most Complete Information In Order To Help You Find The Life Insurance Policy That’s Best For You?

Let’s Face It, When It Comes To Any Medical Problem, It’s Confusing To Try To Get Life Insurance.

Just know, that there’s an awesome life insurance policy out there for you!

By Paying Attention To This Guide, Learning About The Condition, And Understanding What The Life Insurance Companies Are Looking For Will Put You Miles Ahead On The Road To Low-Cost High-Quality Sleep Apnea Life Insurance.

So Enjoy, Learn And Share This Resource With Those You Care About!

What Is Sleep Apnea

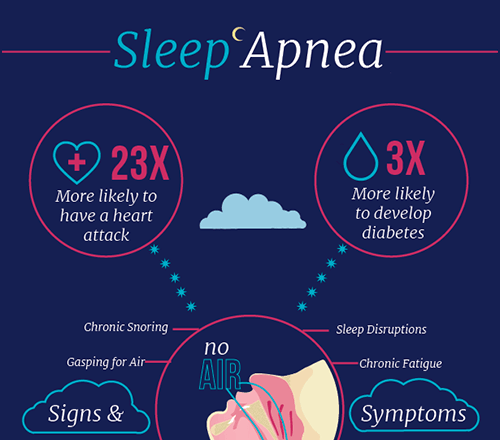

Sleep apnea is a sleep disorder characterized by pauses in breathing or periods of shallow breathing during sleep. Each pause can last for a few seconds to a few minutes, and they happen several times a night. In it’s most common form, this is followed by loud snoring.

There Are Three Types Of Sleep Apnea:

- Central Sleep Apnea (CSA)

- Obstructive Sleep Apnea (OSA)

- Mixed Sleep Apnea (Both Central Sleep Apnea And Obstructive Sleep Apnea)

What Is The Life Expectancy Of Someone With Central Sleep Apnea (CSA)?

Central sleep apnea (CSA) is characterized by symptoms of frequent starts and stops of breathing during sleep, which leads to regular nighttime awakening.

CSA is much rarer and occurs when an abnormality in the brain fails to maintain proper breathing when you are asleep. The estimated average lifespan of someone who suffers from CSA is 20 years shorter than the norm.

Some of the causes of CSA can be extremely serious. Here are a few:

- Problems that affect the brain-stem, including brain infection, stroke, or conditions of the cervical spine (neck)

- Severe obesity.

- Certain medicines, such as narcotic painkillers.

What Is The Life Expectancy Of Someone With Obstructive Sleep Apnea (OSA)?

People who suffer from moderate to severe OSA are 4x more likely to die when the sleep disorder is left untreated. If your OSA is untreated, you are likely sleep-deprived.

Adequate uninterrupted sleep is essential for our bodies to heal itself. And the frequent fragmenting of your sleep caused by sleep apnea’s dysfunctional breathing patterns means you aren’t getting the restorative rest your body and brain need to function at optimal levels, potentially causing you to injure yourself.

What Are The Consequences Of Untreated Sleep Apnea?

Sleep apnea can have severe and life-shortening consequences if left untreated. Sleep apnea is associated with heart disease, high blood pressure, diabetes, and stroke. Sleep apnea can cause depression, impotence, memory problems, headaches, and weight gain. It has even been linked to car accidents caused by people with sleep apnea falling asleep at the wheel.

What Is Continuous Positive Airway Pressure (CPAP)

Continuous Positive Airway Pressure (CPAP) is the leading therapy for sleep apnea where patients wear a face or nasal mask during sleep. The mask is connected to a pump that provides a positive flow of air into the nasal passages to keep the airway open.

How Many Years Does A CPAP Machine Last?

Save money by maintaining your CPAP machine![if you take care of your machine you’ll be able to afford your term insurance premium!]

Speaking of life expectancy, the average life expectancy of a CPAP machine is about 20,000 hours, or approximately seven to eight years of full-time use.

If properly cared for, a CPAP machine will last much longer. Many properly maintained machines have been known to last as long as 50,000 hours.

However, you may find that you will have to replace your mask more frequently as they do wear and tear and for hygiene reasons. The good news is that most health insurers may provide new supplies according to these replacement schedules.

Check with your insurer to find out if you’re eligible to have your CPAP equipment replaced regularly.

Sleep Apnea Is Linked To Heart Disease-Life Insurance Companies Hate Co-Morbidity Factors!

A new study found that obstructive sleep apnea is linked to an increased risk of heart failure and coronary heart disease in middle-aged and older men.

“Men with severe obstructive sleep apnea were 58 percent more likely to develop new congestive heart failure over eight years of follow up compared to men without sleep apnea,” says Daniel Gottlieb, study author and associate professor of sleep medicine at Harvard University’s School of Medicine.

Researchers monitored 1,927 men and 2,495 women over 40 years of age.

All participants were free of coronary heart disease and heart failure at the start of the study. Study participants used polysomnograms as they slept to measure the presence and severity of sleep apnea as calibrated on the Apnea-Hypopnea Index (AHI). According to Dr. Gottlieb, “…there is a lot of undiagnosed sleep apnea, and that, at least in men; it is associated with the development of coronary heart disease and heart failure. Only about 10 percent of sleep apnea cases are ever(sic) diagnosed.”/p>

Do You Know How Much Life Insurance You Need? Find Out Below!

People Suffering From Any Type Of Sleep Apnea Can Typically Get Some Form Of Life Insurance.

Because obstructive sleep apnea is the most common type of sleep apnea, it will be the main focus of life insurance underwriting.

With an individual policy, only people with obstructive sleep apnea, typically can get life insurance.

Unless you can document that your CSA condition was temporary, or caused by environmental factors.

For example, high altitude. Sleeping at an altitude higher than you’re accustomed to may increase your risk of sleep apnea.

High-altitude sleep apnea is no longer a problem when you return to a lower altitude.

This situation would most likely be favorably viewed by insurance companies who specialize in life insurance with sleep apnea.

The underwriting scenario for people with obstructive sleep apnea would be “standard” life insurance rates.

However, there are select companies that may consider better rates if everything else about you meets their requirements.

How To Get A Sleep Apnea Life Insurance Policy Issued With The Best Possible Rates

What is “being rated” for life insurance?

“rating” is a surcharge based on an expectation of higher claim expenses due to any medical condition, family history-related medical conditions, or lifestyle activities.

Sleep apnea will affect the insurance rating and premium.

If you have a chronic condition, you are more likely to be rated than someone with a temporary health problem.

The severity of the health problem also plays a role in setting the rating.

When your sleep apnea is properly treated and is under control, it may not be a factor in determining your premium.

Insurance companies take sleep apnea very seriously when considering applications for life insurance.

In some cases, insurance companies will decline sleep apnea for life insurance coverage.

In the event that the policy is approved, expect the premiums will be higher compared to an otherwise healthy person.

In addition to higher premiums, some life insurance companies limit the amount of coverage they will provide to a person who has sleep apnea.

The life insurance company will want to know that you are seeking treatment if you have sleep apnea.

Life insurance companies like to see using CPAP on a regular basis, how consistent you are with the treatments, and the results of your sleep study.

Premium rates range from standard to preferred if the condition is severe and if you are complying with the treatment regimen.

When getting approved for term life insurance with sleep apnea, the first thing that the insurance company will want to know is are you wearing your CPAP on a regular basis.

They’re also going to want to see the results of wearing your CPAP, also known as a sleep study.

As with most high-risk life insurance conditions, people are expected to pay more for their life insurance premium if they suffered from sleep apnea.

The key is demonstrating that your sleep apnea is controlled and you’re taking all the necessary steps to treat it.

If you can demonstrate that and you have no other conditions, then, you can enjoy cheap term life insurance.

For people diagnosed with Obstructive Sleep Apnea (OSA), many medical insurance companies will provide payment for a medically-indicated sleep study and also cover for in-home sleep studies.

They may even cover the CPAP machine and other related accessories and supplies, provided that specific coverage criteria are met such as physician chart notes, diagnosis of OSA, qualifying sleep study, and prescription from your treating physician detailing what equipment and supplies are needed.

Bottom Line Is That Insurance Carriers Want To See An AHI Of Less Than 5 With Or Without Use Of A Corrective Device, CPAP Treatment, Or Surgical Treatment In Order To Consider You For “Preferred” Rates On Your Policy

If you can achieve this, and you have good vital signs and a decent health history, you could possibly qualified for “preferred” rates.

However, most folks who suffer from sleep apnea have multiple health conditions, and that’s what scares the insurance company underwriters.

In medical parlance, these are called “co-morbidity” factors, and the more of these factors you have, the more difficult it will be to get “preferred” or “standard” life insurance rates.

The choices for people who suffer from central and mixed apnea are limited, and they may need get their life insurance with a group plan through their employer or consider some form of guaranteed issue policy.

Here at Alaska Sleep Clinic, we don’t just diagnose and treat those with sleep apnea. Our website was named one of the Top 5 Sleep Education Websites in the World, with over 5 million people visiting our site last year alone, looking for answers to their sleep-related questions and problems. Take advantage of our Sleep Education Center anytime. Plus, our weekly updated blog aims to provide you with answers and information to all of your sleeping questions.

Is Sleep Apnea Considered A Pre-Existing Condition For Sleep Apnea Life Insurance?

Several chronic respiratory disorders such as sleep apnea may be considered pre-existing conditions and may result in patients to be charged higher rates for insurance. Additionally, one insurance company in one state might accept a patient with sleep apnea while another would not.

According to Adam Amdur, the executive director of the American Sleep Apnea Association says:

“A diagnosis of sleep apnea can result in a ‘decline to cover’ by a life insurance company. If the insurance company does provide coverage, it will be [at] a much higher rate and [with] a limitation in the amount of coverage available.”

Many insurance companies consider sleep apnea a high risk. Anything that increases risk for the insurer will ultimately result in the increase in the premiums that you pay. However, depending on the severity of your sleep apnea, you may be able to qualify for standard or even better rates.

Could I Be Denied Insurance Because Of My Sleep Apnea?

Sleep apnea alone would not be a reason for outright denial. However, if other known risk factors, such as obesity and high blood pressure are present, it could result in a less than favorable life insurance rating and much higher life insurance premiums. It may even result in either a decline in coverage.

Another factor that could affect life insurance consideration is the level of treatment you are undergoing to treat your sleep apnea. Expect an unfavorable decision if you cannot show that you are not undergoing treatment for your condition.

It is true that in general terms, certain companies are “friendlier” to people with certain risk factors than other companies. Some may be more competitive for people with OSA, others for people with a cancer history, and still others for people who climb mountains. But carrier selection is not that simple.

At Alaska Sleep Clinic, we don’t just diagnose and treat those with sleep apnea. Our website was named one of the Top 5 Sleep Education Websites in the World, with over 5 million people visiting our site last year alone, looking for answers to their sleep-related questions and problems. Take advantage of our Sleep Education Center anytime. Plus, our weekly updated blog aims to provide you with answers and information to all of your sleeping questions.